Businesses are investing in technology to expand online operations and facilitate remote work during the pandemic. But many of those same businesses are also eager to see their employees return to the workplace in greater numbers over the long term. Those are among the findings of a new survey of SMBs leaders, conducted by The Harris Poll and sponsored by CIT, a division of First Citizens Bank.

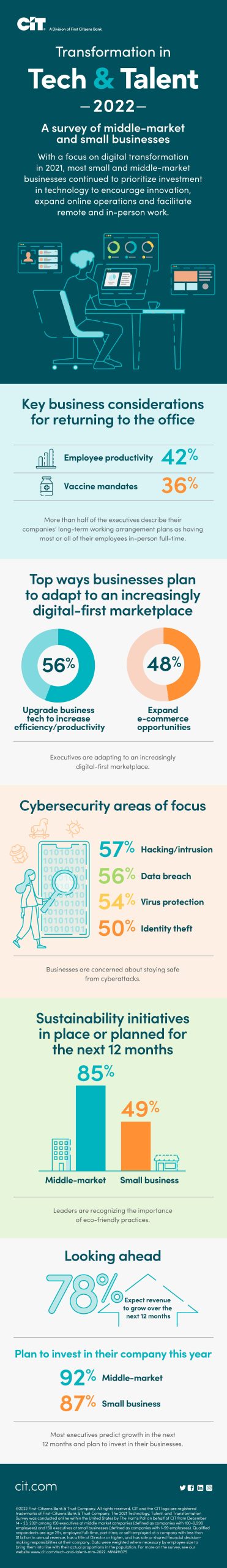

Nearly one in three small businesses (31%) indicate they are planning to invest in technology over the next year to facilitate work on-site or in a physical workplace. When planning to have employees working in-person, business executives are most commonly thinking about employee productivity (42%) and vaccine mandates (36%). Another key factor business executives consider is a new business or customer needs (33%).

Middle-market companies are pursuing many of the same business objectives but are showing more flexibility about hybrid work schedules (34% of middle-market executives plan to have their employees split their time between in-person and remote in the long-term vs. 22% of small business executives).

But ‘lessons learned’ from the pandemic continue to evolve as half of the business executives surveyed (50%) said they’ve reassessed improvement opportunities at their company since the pandemic hit.

“Leaders continue to discover new strategies to advance their growth and are focused on using the intersection of technology and talent to drive business transformation,” said David Harnisch, President of CIT’s Commercial Finance & Real Estate group.

Looking at the year ahead

Most businesses (78%) expect their company’s revenue to grow and plan to make investments in their company over the next 12 months (87% of small businesses, 92% of middle-market businesses).

Among those planning to invest, they plan to allocate the greatest proportion of their investment in:

- Small businesses – equipment upgrades (22%, on average) and marketing and advertising (20%).

- Middle-market companies – tech/software upgrades (18%), research and development (14%) and marketing and advertising (13%).

“We’re committed to delivering technology-driven solutions to meet the unique needs of business owners,” said Ken Martin, Managing Director of CIT’s Business Capital group. “It offers a seamless lending experience that transforms business buying by providing speed and convenience when purchasing equipment.”

To adapt to an increasingly digital-first marketplace, companies are planning to upgrade business technology to increase efficiency and/or productivity (56%) and increase e-commerce opportunities for customers (48%).

Automating payments and billing processes is another key investment for middle-market businesses over the next year, with 83% planning to increase or improve this process. Similarly, small businesses are more likely, compared to last year, to plan on investing in innovative payment methods (38% vs. 19%) and automation (21% vs. 13%), as well as customer relationship management tools (42% vs. 30%) and e-commerce (38% vs. 27%).